Financial well-Being

Empower Retirement Resources

Meet your Penn State Health myretirement Plan representative

To contact an onsite representative, call 717- 531-1878 or email PSH_Retirement@pennstatehealth.psu.edu (in your message, please provide the best number or email address to reply). Counselors can help you with investment selection, retirement planning, and emergency savings.

Myretirement Plan Web Tools

Log into your Penn State Health myRetirement Plan:

Empower Learning Center

Check out the Empower Learning Center. There is a lot of great videos, tools and resources specifically on Planning for Retirement, Building Emergency Savings, Boost Your Savings, Taking Charge of Your Money with a Budget, Investing 101, Navigating Life Events, and much more.

SupportLinc Financial Resources

SupportLinc EAP program includes financial consults at no cost to all employees and household members when needs arise. Available resources include:

- Financial consultation hotline. Financial counselors can address questions regarding financial management, including debt reduction, home buying, budgeting, college planning and bankruptcy prevention.

- Debt management planning. Learn how to work with creditors to build repayment plans for unsecured debt.

- Bankruptcy prevention. Understand the ramifications of bankruptcy filing determine whether other options are more appropriate.

- Housing education. SupportLinc financial counselors help you prepare for a home purchase. They can also outline options for keeping your home in times of financial distress.

To explore the financial resources available within SupportLinc, contact 888-881-5462 anytime, day or night or visit supportlinc.com code: psh

Access Pre-Recorded Wellness Trainings

Public Service Loan Forgiveness

As a non-profit health system, Penn State Health employees may be eligible for the federal Public Service Loan Forgiveness program. If qualified, employees can pay-off their student loan debt in as little as ten years. For more information and or assistance, go to studentaid.gov/manage-loans/forgiveness-cancellation/public-service.

Guild Tuition Assistance

Penn State Health has created a new tuition assistance program that provides employees access to academic institutions with little to no out-of-pocket tuition costs (employee will be responsible for taxes assessed on their paycheck for the tuition). The program is offered in partnership with Guild, a career opportunity platform, to help employees find and access high-quality learning opportunities.

You can enroll in learning programs like:

- College degrees and certificates in high-growth areas

- High school completion* and college preparatory programs

- English language learning.*

*Employees enrolled in high school completion and/or ELL, must be completed prior to enrolling in any other Guild programs.

Important note regarding taxes:

Penn State Health provides you up to $5,250 in educational assistance per calendar year. Tuition costs will be assessed for PA state, local and unemployment tax (approximately 5%). This will be assessed in one pay period. If you exceed this amount in a calendar year, it will be reported as taxable income and employees are responsible for paying all associated taxes including federal, social security and medicare. Employees should contact a tax advisor for additional information on potential tax liability and the specifics by state. For more tax information, read this article on Guild’s Help Center (Article Detail (site.com)).

Visit pennstatehealth.guildeducation.com to get started and apply to a program in your Guild catalog today!

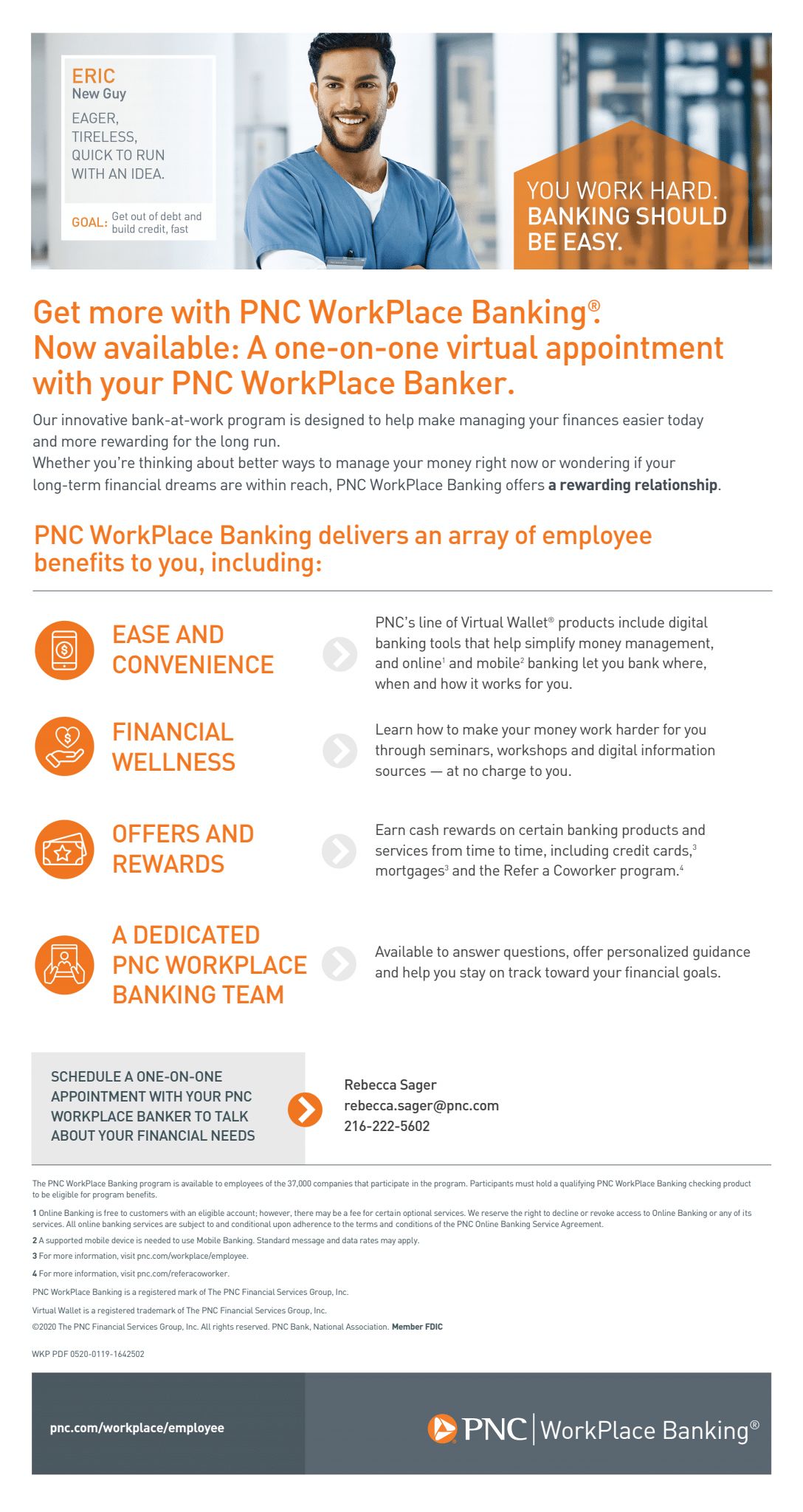

Select Customer Offers from PNC WorkPlace Banking®

You must use this link to learn what rewards or offers may be available to you and to apply for an eligible PNC WorkPlace Banking Virtual Wallet product. Learn More and Apply Now.

Select offers may be available to employees of your company.

©2022 The PNC Financial Services Group, Inc.

All rights reserved. PNC Bank, National Association.

Member FDIC

Abenity Employee Perks

Penn State Health provides members with exclusive perks through Abenity. There are financial perks.